The housing market forecast for 2025 suggests a more favorable environment for buyers and sellers, primarily due to expected reductions in mortgage rates and stabilization of home prices. Here’s a breakdown of how these key factors might shape your decisions:

1. Mortgage Rates Expected to Decline

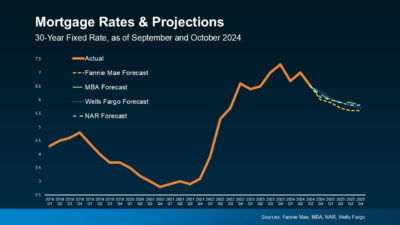

Experts predict that mortgage rates, which spiked significantly in recent years, will gradually decline in 2025. This potential decrease could make financing more accessible, improving affordability for prospective buyers. Lower rates also tend to increase purchasing power, enabling buyers to afford more expensive homes with the same budget. For sellers, lower mortgage rates could bring more buyers into the market, which could help maintain demand.

2. Increased Buyer Demand

Buyer demand in Coastal Orange County could increase. Lower rates make borrowing cheaper, allowing buyers to afford larger loans and higher-priced homes, which is particularly important in areas like Newport Beach, Corona del Mar, and Lido Isle where properties are often priced well above the national median.

-

Luxury Buyers: Coastal Orange County has a high concentration of luxury homes, and a reduction in mortgage rates could make financing these properties more appealing to high-net-worth individuals who prefer to leverage borrowing even when they can afford to buy outright.

-

First-Time Buyers: Although the market remains expensive, a dip in mortgage rates could allow first-time buyers to access homes they may have been priced out of before, especially in nearby areas that are relatively more affordable compared to oceanfront communities.