It’s true that Presidential elections can influence the housing market, though the impact tends to be relatively minor and short-lived. While Presidential elections can introduce a bit of uncertainty and cause minor, temporary effects on the housing market, the overall long-term trends are driven by more fundamental economic factors. Here’s a closer look at how elections affect critical aspects of the housing market:

Home Sales:

– Slight Slowdown in November: Historically, there is a slight slowdown in home sales during the month of November in election years. This slowdown is typically due to uncertainty and hesitation among potential buyers and sellers.

– Bounce Back in December: This slowdown is usually temporary. Home sales often bounce back in December and continue to rise in the following year.

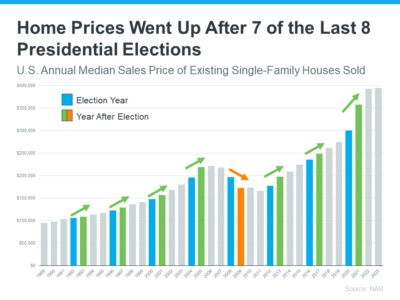

The latest data from NAR shows after seven of the last eight Presidential elections, home prices increased the following year (see graph below)

Home Prices:

– Stability: Home prices generally remain stable during election years. While some markets may see slight fluctuations, these are typically not significant enough to cause concern.

– Long-Term Trends: The long-term trends in home prices are influenced more by economic factors such as supply and demand, interest rates, and overall economic health rather than the election itself.

Mortgage Rates:

– Temporary Fluctuations: Mortgage rates may experience temporary fluctuations during election years due to uncertainty in financial markets. However, these fluctuations are usually short-lived.

– Economic Factors: Like home prices, mortgage rates are more significantly influenced by broader economic factors, including Federal Reserve policies, inflation, and the overall economic outlook.