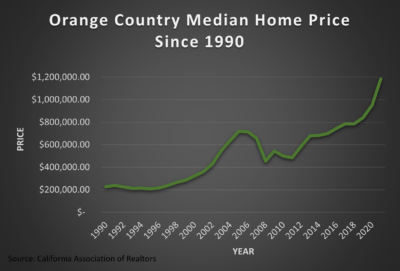

Real estate is the most consistent asset in terms of long-term returns. In prime areas like Orange County the value of property is going to rise. There is a fixed supply and always a demand to live in Southern California. In Orange County the 20-year appreciation rate is 192% and the 10-year is 124%. Nationally the average 10 and 20-year appreciation rates are 129% and 76% respectively [1]. Real estate is a very strong asset class everywhere but especially here in Orange County. Consistency is key. Real estate can create generational wealth, security for your family and does not swing wildly in price like other investments.

Real estate is a known inflation hedge. If you possess a fixed-rate mortgage it is a huge advantage with inflation allowing the value of your equity to increase while your payment remains the same. Also income generating real estate is very effective at keeping pace with inflation because of the ability to increase rents and keep a steady stream of income. The ability to quickly adjust prices can even lead to outpacing inflation and a rise in profits for landlords [2].