There’s been a lot of chatter about a possible recession lately, sparking concerns of a repeat of the 2008 financial crisis. However, let’s delve into the latest insights from experts to understand why this isn’t the case.

Jacob Channel, a Senior Economist at LendingTree, offers a reassuring perspective, stating that despite some ups and downs, the economy’s fundamentals are actually quite robust at the moment. While it’s not flawless, the economy is likely in better shape than many might acknowledge.

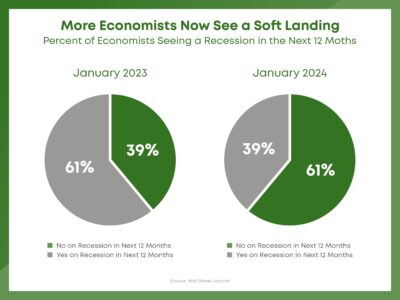

Recent data from the Wall Street Journal’s survey indicates a significant shift in economists’ sentiments. Only 39% now anticipate a recession within the next year, a notable decline from the 61% who predicted one just twelve months ago.

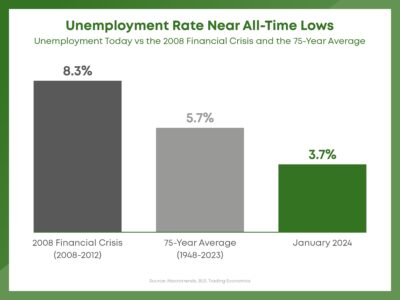

One key factor bolstering this optimism is the current unemployment rate. Comparing historical data from sources like Macrotrends, the Bureau of Labor Statistics (BLS), and Trading Economics, it’s evident that our present unemployment rate remains relatively low. For instance, the unemployment rate in January (depicted in graph below) is notably lower than both the historical average and the peak rate following the 2008 financial crisis.

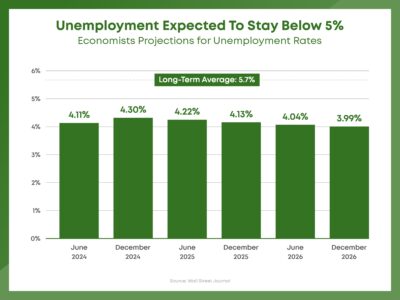

Looking ahead, projections from the same Wall Street Journal survey paint a promising picture regarding unemployment over the next three years. Experts anticipate that the unemployment rate will remain well below the long-term average, let alone the peak rate observed during the previous market crash.

While it’s acknowledged that job losses are always concerning, projections suggest that they won’t reach levels sufficient to trigger a wave of foreclosures capable of destabilizing the housing market. Despite this, it’s important to acknowledge the potential challenges individuals and their communities may face during periods of unemployment.

The bottom line is that the prevailing sentiment among experts is that a recession is unlikely in the coming year, with a minimal expected impact on the unemployment rate. Therefore, fears of a housing market crash due to foreclosure floods may be unfounded.